June 2020 revenue results, amongst our survey set of 50 leading direct selling companies, continued to indicate strong sequential sales growth across the majority of the industry.

This is the fourth month in a row that we have reported similar results to you, which—we believe—is past the point of a pleasant anomaly and now indicative of a trend and potential inflection point within our industry.

As an industry, we are particularly susceptible to momentum-based swings—both positive and negative. Right now, it is clear that momentum is on our side.

As most of you know, June is historically a slow month for a large portion of the direct selling industry. This fact has traditionally been attributed to kids being out of school and summer vacations diverting the attention of a sales force demographically oriented towards women with children.

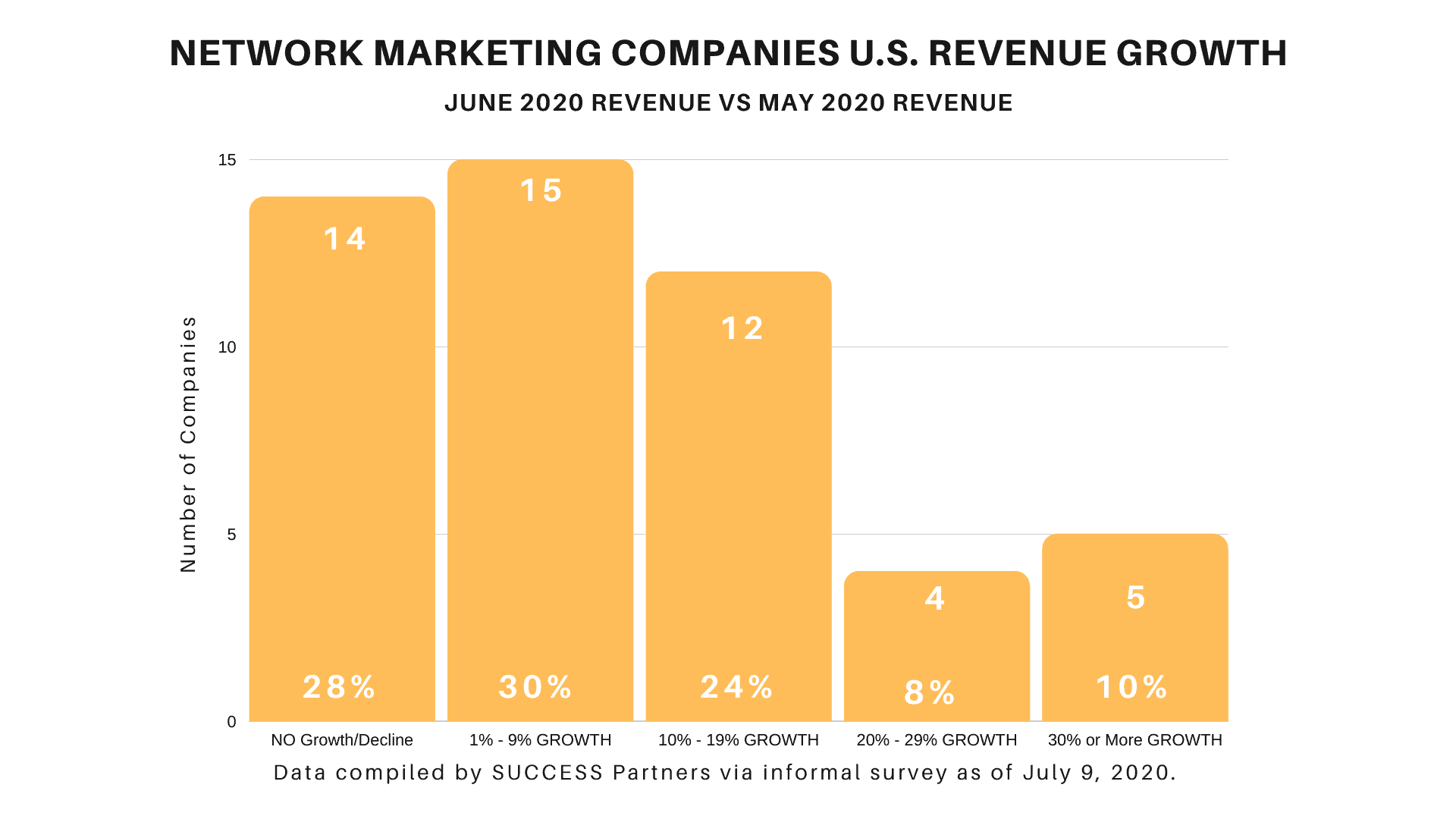

Not this year. More than 10 respondent companies reported record monthly revenue during the period and, referring to the chart below, you will see that more than 70% of respondents reported a sequential increase in revenue when comparing June 2020 to May.

June At A Glance

- 12 companies reported record revenue for June

- 70% of companies reported growth June over May

- 28% remained flat or declined

- 30% showed single-digit growth

- 42% grew by double digits or more

JUNE 2020 CHART

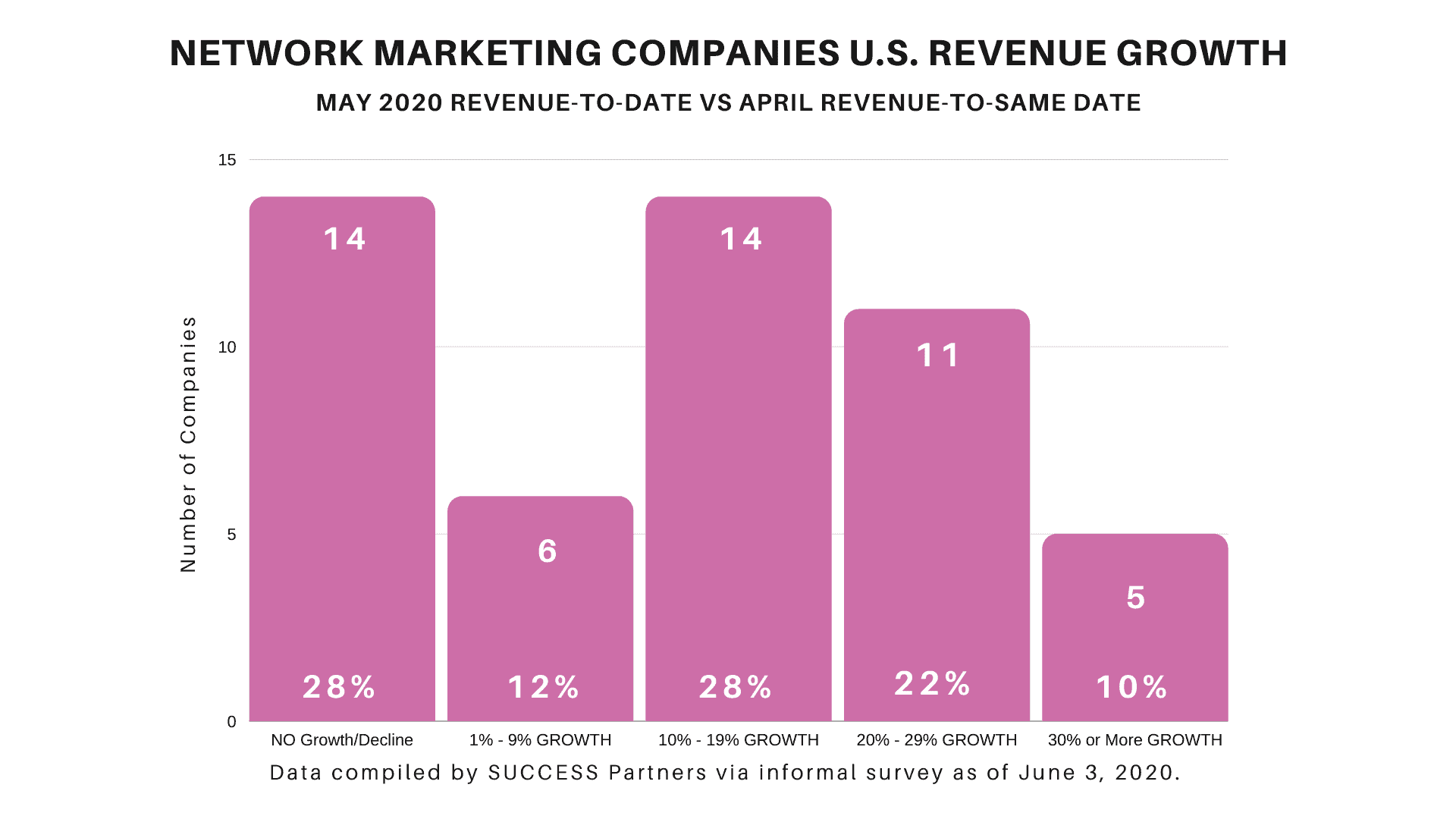

The June results follow equally strong results in May (72% of respondents grew revenue over April), April (80%) and March (80%).

Key Takeaways

The consistent growth shown by our industry during the pandemic—especially in June—is starting to break wide open some long-standing industry norms and push projections and expectations past any relevant historical comparison.

Historically speaking, June’s growth figures would be the inverse of what they are today (30% growth / 70% decline). Further, the majority of those companies that did grow in June over May would have been readily attributable to a specific catalyst, such as a product launch, event or the continuation of a hockey-stick like explosive growth curve.

It’s important to note that while the number of companies reporting high percentages of growth (10% or more) month-over-month declined, the same number grew during the same time period. This growth was achieved on a higher prior month revenue base and during the historically slow month of June, leading us to find the results all the more impressive.

Additionally, most respondents report that Q2 2020 revenue exceeded that of Q1, and many have exceeded first half 2019 revenue in the first half of 2020. Finally—anecdotally speaking—customer acquisition and recruiting statistics continue to trend higher and surpass comparable periods from one year ago.

The four large public direct selling companies listed on US exchanges are expected to report their Q2 2020 financial results between now and the first week of August, with USANA Health Sciences (NYSE: USNA) the first to report on July 21, 2020.

We expect the public companies to report results confirming the trends we have seen through these informal surveys. You can expect to receive a report highlighting these results from our affiliated company, Transformation Capital, LLC, in the second week of August.

Contributing Factors

Below is a summary derived from the past four months of our insights into what the growth companies have in common.

1. Making the necessary shifts to prioritize customer-centric initiatives and efforts. The growth companies have identified and clarified their customer acquisition and selling systems and most importantly, they’re communicating and reinforcing them at every touch point—keeping the field focused and activities aligned.

To learn more about what’s working in customer acquisition strategies and to hear what Wayne Moorehead, CMO of Young Living and former CBO of the direct-to-consumer mattress brand, Purple, believes are the five shifts to improve customer acquisition, click here to watch the most recent episode from our Executive Insights Webinar Series. The unsolicited responses in the last 24 hours since the airing have been incredible:

“A must watch!” “It was AWESOME!” “Phenomenal training.”

1. Provide distributors the functionality and technology to easily execute the systems. Identifying the system is only one piece of the puzzle. Companies that provide their field with the right tools that are simple and convenient to use and that support the system is how results and growth happen. Technology is the functionality distributors need to execute the systems at speed and scale.

We see continued growth in the use of mobile apps and sampling systems for many of these remarkable growth companies. In fact, since January 2020, we have seen our mobile-based NOW app offering grow 5X in the collective user base alone!

1. More content and more communication. Companies that are growing have been creating a steady stream of compelling content their field can easily access and share. Product stories and testimonials are powerful tools to strengthen engagement with existing customers and distributors as well as attract new ones.

A balanced marketing strategy that includes digital and physical components continues to be a thread. Keeping it easy to deploy and share across multiple platforms, mediums and devices to maximize reach is another key initiative.

1. Strategically utilizing external resources to scale bandwidth and maximize output. Working remote has required a constant state of shifting and adapting at all levels. One example, shifting from physical to virtual events alone has required marketing departments to pivot quickly and learn an entirely new way to execute in a condensed timeframe. Impact and strain on resources, projects and bandwidth have been a natural byproduct.

Successful companies aren’t scaling back on initiatives, they’re leveraging opportunities by partnering with experienced companies and resources such as, SUCCESS Partners.

Looking Forward

It would be unreasonable to expect the current growth trend to continue, unabated, over the long-term. There will be bumps in the road, driven by and attributable to a multitude of different factors—some typical, some not and some that we can’t even imagine as we sit here today.

If the last four months have taught us anything—it’s to expect the unexpected. However, we believe it to be a reasonable and safe prediction that the current environment is not changing anytime soon. Therefore, we have no reason to expect anything other than a continuation of the general trends we are currently experiencing in the near term and, potentially, the mid-to-longer term.

The shift of “work from home” into the social and professional mainstream as well as a likely prolonged period of relatively high unemployment, cannot be ignored as significant tailwinds for our industry.

As evidence of this, we were pleasantly surprised to learn, that approximately 8-12 legacy industry companies are on track and/or projected to reach record revenue this year on a renewal basis (meaning they peaked, troughed and are now poised to once again climb to record annual revenue).

Bottom line? Micro-entrepreneurship, gig economy, work from home—whatever you want to call it—is working.

Our Commitment to You

We are here to serve this industry, community and the executives that lead it. We will continue to update you on the trends, strategies and approaches that are producing results in the direct selling channel.

To submit suggestions on topics you’d like to see more information about, please email our team at in**@*************rs.com.

Best,

Stuart Johnson

CEO and Founder, SUCCESS Partners

* The total data set consists of more than 60 companies, with criteria including headquarters based in the U.S., a minimum of $5 million per month in revenue, and a substantial percentage of revenue from U.S. business. Public companies did not participate. Half of the companies are not members of the Direct Selling Association.

0 Comments