Private Company Tracking Set Returns to Sequential Growth – Domestic Market Remains on Track for Record Annual Revenue

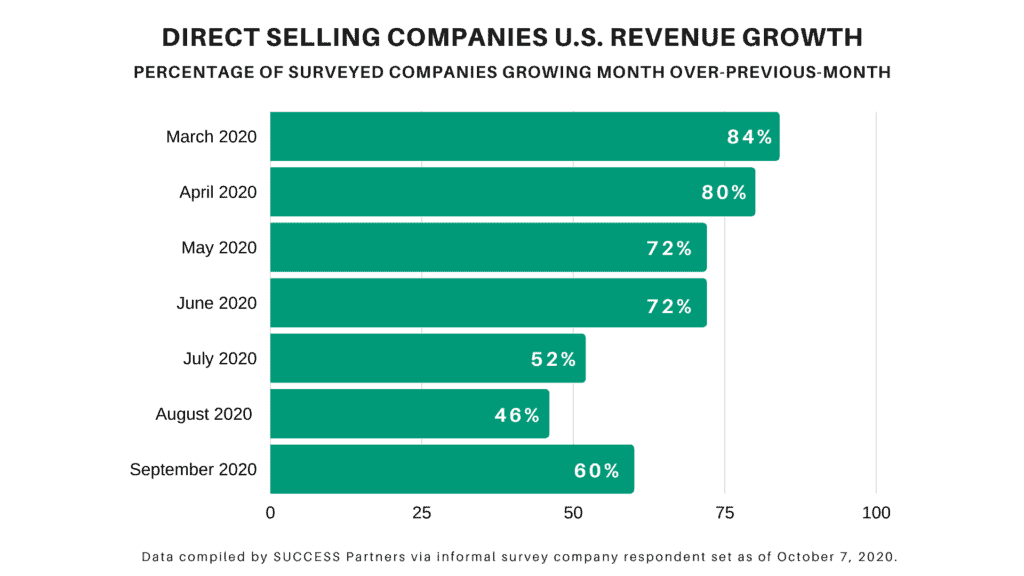

As we predicted last month, and after a one month pause, the majority of our private company tracking set returned to sequential growth in September. Of the 50 included domestic direct selling companies with a minimum of $5 million in monthly revenue, 60% saw revenue increase in September as compared to August. Further, 32% of respondent companies grew revenue more than 10% during the period and 8% grew more than 20% on a sequential basis.

This now represents six of the last seven months that the majority of companies within the tracking set have reported sequential revenue growth. This impressive record has been achieved on top of a, for the most part, ever-increasing baseline.

The growth of the direct selling industry over the last several months has been nothing short of remarkable. As we have stated previously, we believe that 2020 domestic revenue will achieve a record amount surpassing the $36.1 billion achieved in 2016. In support of this belief, we present you with the following:

- We are now tracking 70 domestic, privately held direct selling companies that will generate at least $50 million in sales during calendar 2020.

- 80% of these companies have increased revenue year-to-date as compared to 2019.

- As much as 50% of these companies will set annual revenue records in 2020.

- 25 of the 70 companies will grow revenue $100 million, or more, in 2020 as compared to 2019.

- At least 5 will double revenue in 2020 as compared to 2019.

Finally and most impressively, these 70 companies will collectively generate a minimum of $5 billion more in revenue this year (2020), than what was generated in 2019.

So, what does this all mean? It means that the thesis we have been preaching to anyone who would listen since April has been proven correct – domestic direct selling is back, and in a big way. While the pandemic environment we have been operating in for the last seven months will eventually end, we believe many changes brought on during this period will endure long after the threat associated with COVID-19 has ended. For example, Global Workplace Analytics, one of the nation’s leading authorities on work-at-home, estimates that 25% – 30% of the United States workforce will continue to work from home, at least half the time, in a post-COVID environment. This is a staggering increase from 3.6% pre-COVID and directly benefits our industry. Additionally, we believe that way people shop, eat, recreate and socialize will be significantly impacted for the foreseeable future. Finally, the US unemployment rate remains at 8% and, while a further recovery is inevitable, it is unlikely to change drastically in the near to intermediate-term. Considering the above, we believe that direct selling remains ideally positioned for continued success and growth through the end of the year and well into 2021. Looking at the remainder of this year specifically, we believe that typical seasonal trends will prevail, including a strong October and November, followed by a holiday-induced slowdown from mid-December through the end of the year.

Stay well,

Stuart Johnson

CEO & Owner | SUCCESS Partners

* The total data set consists of more than 50 companies, with criteria including headquarters based in the U.S., a minimum of $5 million per month in revenue, and a substantial percentage of revenue from U.S. business. Public companies did not participate. Half of the companies are not members of the Direct Selling Association.

0 Comments