We are proud to present this comprehensive model for those interested in the financial aspects of the direct selling industry. We are providing this overview in an effort to continue to provide the direct selling industry, and other constituencies interested in the space, timely and relevant financial content and analysis.

SUMMARY & OUR TAKE

Financial Results Drive Significant Upside – Direct Selling Stocks Outperform Markets

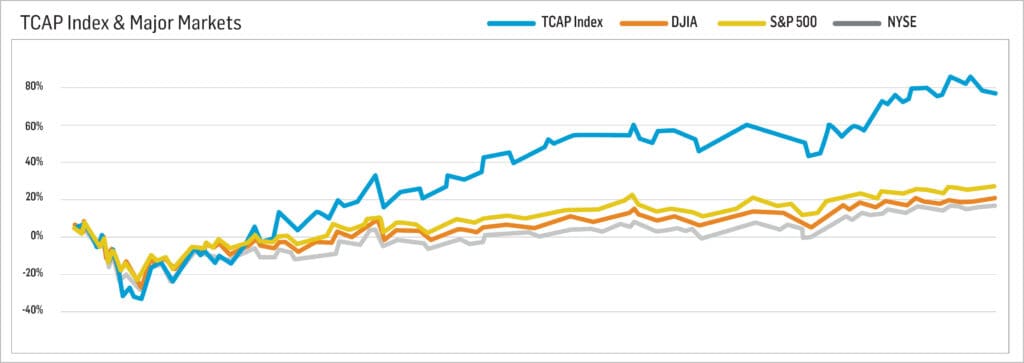

November represented a strong period for direct selling stocks as a whole and this was reflected in the Transformation Capital Direct Selling Index (TDSI), which rose an additional 20% over the course of the period. Direct selling stocks, as a whole, continue to outperform, driven by exceptional third quarter financial results related to uncommon strength in both domestic and European markets.

Overall, the month was defined by upward trends with one notable exception on November 9. Almost without exception, industry stocks were hit hard on this day, which followed positive news regarding potential COVID-19 vaccine candidates and their likely upcoming release for distribution. This one-day setback appears to have been related to a reallocation by some investors away from work-at-home centric stocks, and into other industries and sectors, as the markets as a whole were actually up on the day. For example, Zoom Video Communications, Inc. (NASDAQ: ZM) lost more than 17% on the day. Interestingly, the action appears to have been a short-term, knee jerk reaction as trading volume, while high, was not overwhelmingly so and each of the stocks proceeded to move higher over the coming trading sessions.

Standouts amongst our large cap tracking set included Medifast, Inc. (NYSE: MED), which advanced an additional 45% during the month driven by financials results reported in the first week of November that included revenue up nearly 43% YoY. MED remains amongst the leading stocks within our tracking set with gains of nearly 154% since the end of February. Primerica, Inc. (NYSE: PRI)broke out of a three-month malaise and advanced more than 18% during November driven by strong financial results reported during the month. And, finally, eXp World Holdings (NASDAQ: EXPI) continued its remarkable performance by adding 25.8% to its gains and now stands nearly 458% above February levels.

Most notable continues to be the performance of the domestic market. As we have stated many times, we predict record domestic direct selling revenue for 2020 and third quarter results amongst our tracking set strongly support this thesis. Amongst the multi-nationals that report segmented information, Herbalife reported 55% YoY growth in North American; Nu Skin reported 81% growth in its segment that includes North America; Medifast, which is primarily a domestic company, reported YoY growth of 43%; Tupperware reported growth of 42% and USANA 12%. These are remarkable results from a market that had been stagnant to slightly declining for a number of years.

The smaller cap stocks amongst our tracking set also showed strength during the month with 5 of the 8 companies included posting gains of 10% or more during the period. New Age, Inc. (NASDAQ: NBEV) continued its upward trend began in October by gaining an additional 46% over the course of the month. The stock has been buoyed by optimism surrounding its merger with ARIIX, which closed mid-month. Nature’s Sunshine Products, Inc. (NASDAQ: NATR) rose 19% and has now advanced 51.6% during the pandemic period. On November 9 the Company reported financial results, which included the highest revenue quarter in the Company’s history (up 13% YoY) and a more than four-fold increase in EPS.

0 Comments