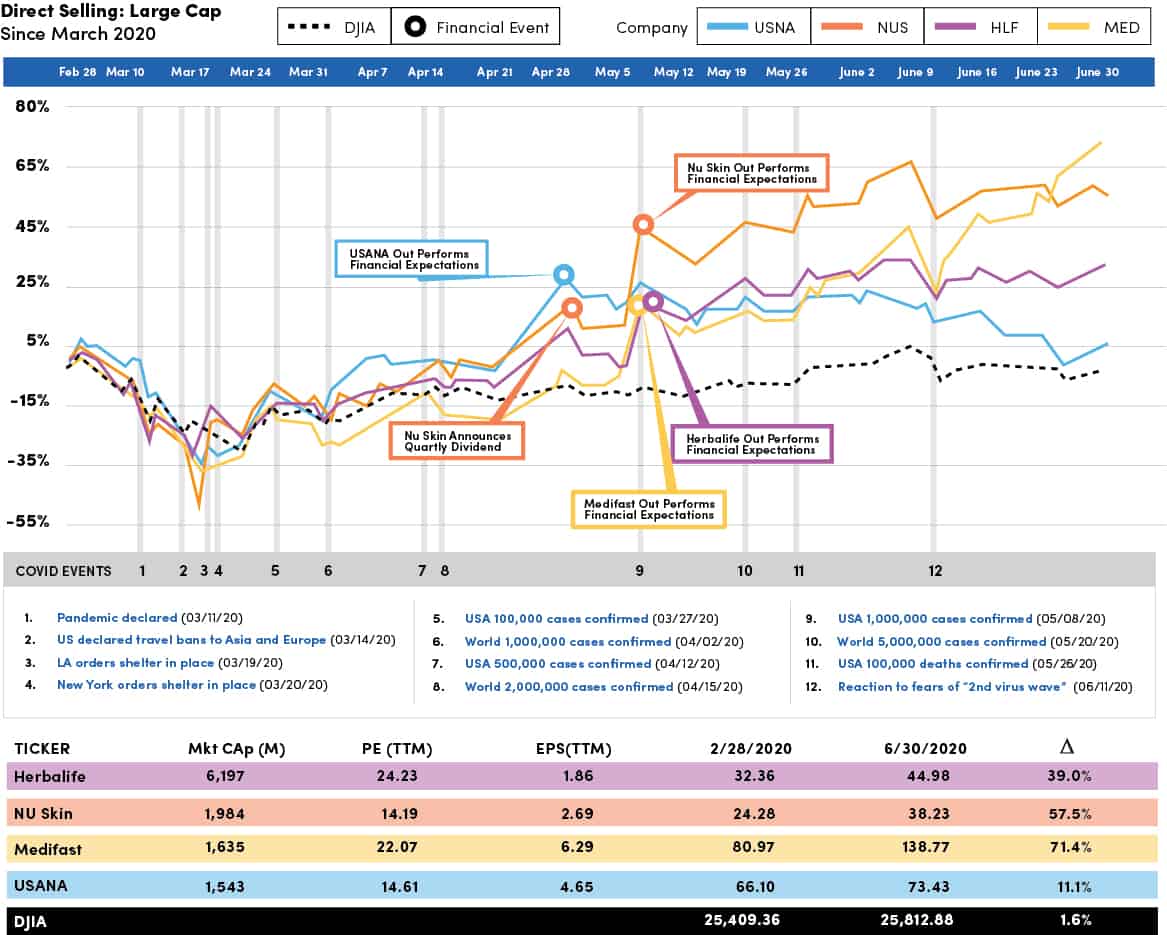

The four leading direct selling stocks continued to outperform the Dow Jones Industrial Average (DJIA) during the current pandemic environment (defined as the period beginning March 1, for these purposes), despite a mixed performance from the group during the month ended June 30, 2020. The DJIA has recorded a decline of 3.33% since March 1, following a slight increase of 1.7% during the month of June. Medifast, Inc. (NYSE: MED) emerged as the clear leader of the group during the month, after rising nearly 37% during the period, and now stands 73% above its February closing price. Medifast has benefited from bullish analyst estimates regarding forward looking revenue, earnings and cash flow. Nu Skin Enterprises, Inc. (NYSE: NUS) rose slightly during the month (2.8%), continuing a strong trend that has seen the stock increase by 56% since the beginning of March, 2020. Similarly, Herbalife Nutrition, Ltd. (NYSE: HLF) increased 2.6% during June and has now increased by 31% since March 1. The single laggard within the group was USANA Health Sciences, Inc. (NYSE: USNA), which declined by 13%. However, the Company remains positive for the subject period and continues to outperform the DJIA.

There appears to be some churning action amongst the stocks, which is likely indicative of profit taking and consolidation after significant runs over the last few months. For example, NUS has more than tripled since its mid-March lows and, similarly, HLF has nearly doubled and MED is up 167%. USNA, despite its June decline, remains up 61% from its mid-March lows.

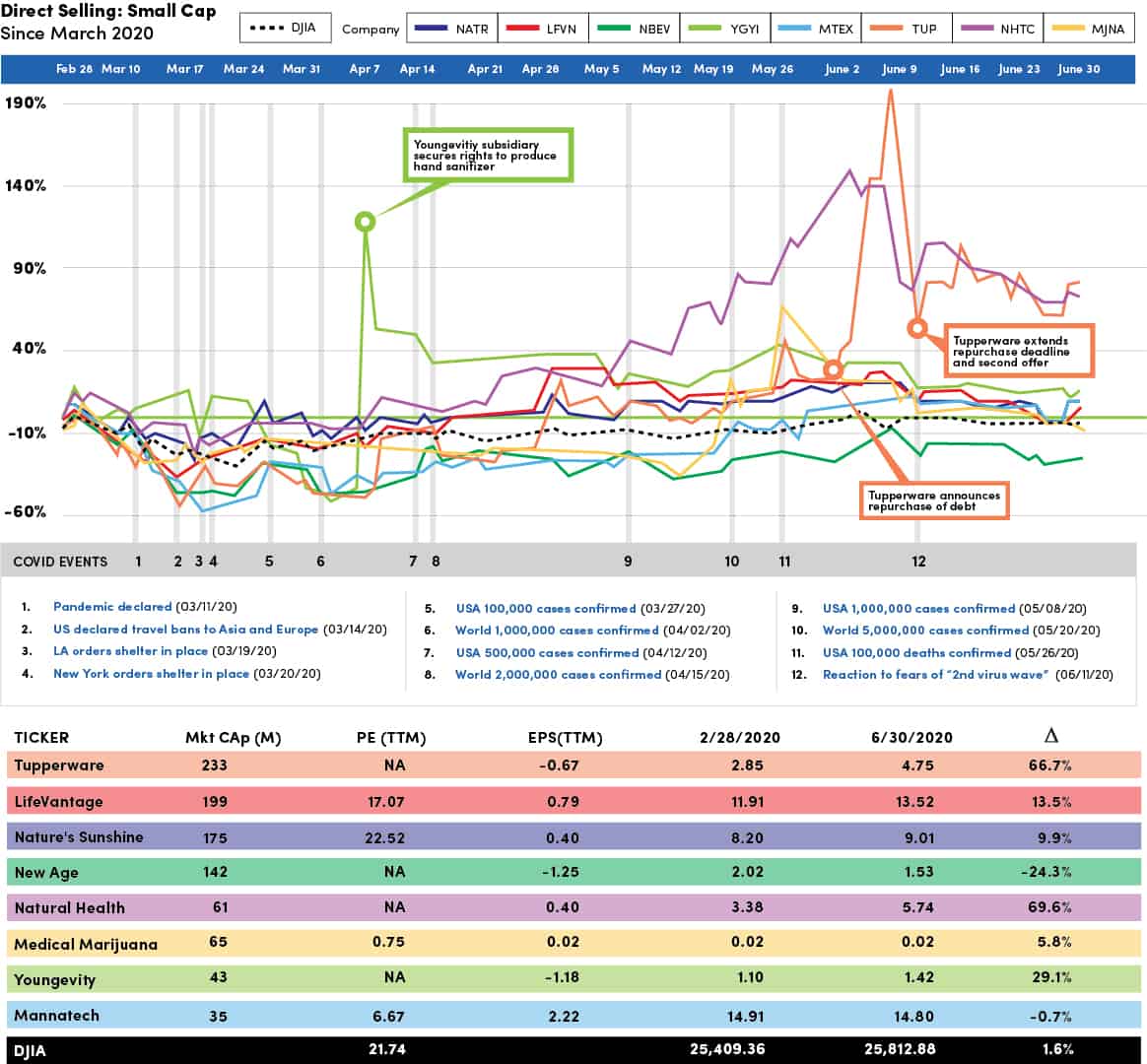

Amongst the smaller capitalization stocks within the industry, all but one of the stocks included in the chart have continued to outperform the DJIA during the subject period. Tupperware Brands Corporation (NYSE: TUP) was a standout during June and surged early in the month, on strong upside volume, before pulling back and ending the month with a gain of more than 45%. Since March 1, TUP has increased more than 75%. Natural Health Trends Corp. (NASDAQ: NHTC) has been the leading performer amongst the small cap stocks during the subject period (since March 1), rising more than 79% over that time and more than doubling since its mid-March low. Mannatech (NASDAQ: MTEX) traded generally higher for the majority of the month, before declining over the course of the last week following the announcement that the Company’s $5 million dutch auction tender of offer was successfully completed at $17 per share. The successful tender offer reduced the Company’s shares outstanding by approximately 12.31%.

While recent performance has been impressive, we believe that, if combined with stable, or upside market action, there could be additional room for the leading direct selling stocks to run. Each of the large cap stocks included in this report reached their recent highs of the last two years in late 2018 and still trade significantly off of those levels. A number of these companies (most notably USNA and NUS) have historically relied on their China business as a significant driver of growth, which was significantly impacted as a result of China’s “100 Days of Action” related to health products market during the first half of 2019, as well as the political unrest evident in the region during the second half of the year. Finally, the early stages of COVID-19 clearly had a negative impact as well. As businesses return to normalcy (or a new normal), we believe there is reason for optimism and remain bullish on the industry as a whole.

Stuart Johnson

Partner

C: (214) 763-2987

E: sp*@***************ap.com

J. Ryan Bright

Partner

C: (214) 315-7601

E: jr*@***************ap.com

0 Comments