This month we have significantly expanded our analysis and data in an effort to continue to provide the direct selling industry, and other constituencies interested in the space, with timely and relevant financial content and analysis. We believe this is a one of a kind offering and we are proud to provide this valuable service to the industry.

As we have stated before, companies within the direct selling industry are most often grouped together with businesses that provide similar products or services, but which utilize different sales and marketing channels. While these comparisons are relevant, we believe that the channel deserves its own platform and that the most salient comparisons lie with other direct selling industry participants. Going forward, you can expect a continued expansion in both the breadth and depth of our offering all with the goal of providing a one-stop shop model for those interested in the financial aspects of the direct selling industry.

SUMMARY & OUR TAKE

Historical Large Cap Tracking Set Consolidates Gains – a Newcomer and Small Caps Lead the Way

August saw the majority of our large cap tracking set record financial results for the second quarter, 2020, which continued to support our growth thesis for the industry in the midst of the current environment. While, as we predicted, there was an element of profit taking during the month, the associated declines were moderate and to be expected following the significant advances experienced by many of the stocks over the last several months. Each of the stocks in our large cap group remain well above their pre-pandemic levels and the majority continue to significantly outperform the major indices.

This month we have added two companies to our large cap tracking group: eXp World Holdings, Inc. (NASDAQ: EXPI), a cloud-based real estate brokerage service for residential homeowners and homebuyers in the United States, Canada, the United Kingdom and Australia, as well as Primerica, Inc. (NYSE: PRI), a provider of financial products to middle income households in the United States and Canada. EXPI has emerged as a significant leader within the space rising 124% during August alone and now stands 365% above its February 28, 2020 closing price.

The smaller cap stocks amongst our tracking set performed well during the month, with all but one showing gains during the period and four rising double digits. Standouts include Sharing Services Global Corporation (OTC: SHRG), the parent Company of Elepreneurs, a health and wellness beverage Company focused on nootropics, which advanced 27% during the month and now stands 1,070% above its February 28 closing price.

Looking Forward

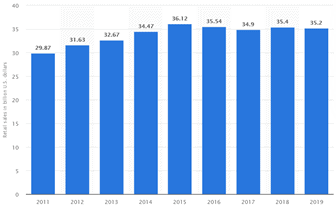

From a broad perspective, we believe that the direct selling industry, as a whole, is experiencing a renaissance within the domestic market. As indicated in the chart below, domestic direct selling revenues have been flat to slightly down since reaching an all-time high of more than $36 billion in 2016.

Historical Direct Selling Revenue

It is our belief that 2020 sales will reach, and likely exceed, that record figure. While it is likely that August experienced somewhat of a seasonal slowdown, we believe that year-over-year trends remain strong when compared to 2019. Looking forward and moving into the fall and winter months, we believe that the industry will see a strong close to 2020 with typical seasonal trends and a continuation of the momentum built over the last six months driving the industry towards a potential record year.

There are a number of bullish indicators for the industry, including the anecdotal evidence we are seeing, as well as the sentiment of the vast majority of analysts covering industry stocks, 97% of which have “buy” or “hold” ratings on the industry stocks they cover. In addition, we are seeing a decline in short interest in industry stocks across the board meaning investors are not inclined to bet against industry stocks at this time.

0 Comments